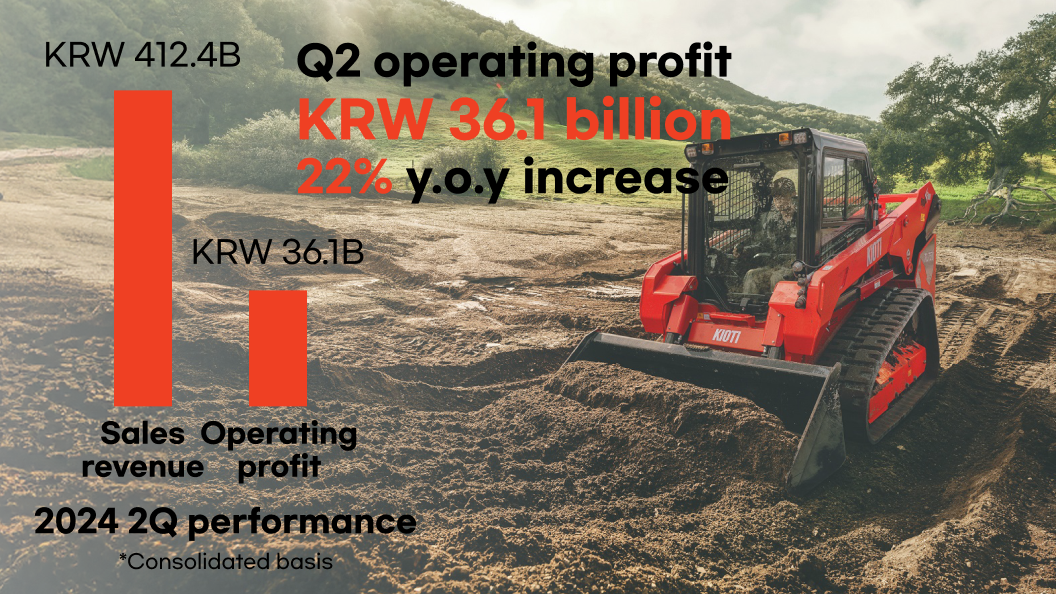

Daedong reports KRW 36.1 billion in operating profit in the second quarter, up 22% Y.o.Y

Daedong reports KRW 36.1 billion in operating profit in the second quarter, up 22% Y.o.Y

- Performance driven by excellent product mix and strategic promotion focused on North America, including medium and large tractors, implements, and small construction equipment

- Company wants to maximize sales of services and parts through its agricultural machinery control services in North America and enter the B2B and B2G markets during the second half of the year

- Domestically, Daedong is launching agricultural robots with AI technology in the fourth quarter and expanding its smart farming solution distribution business

Daedong’s profits have skyrocketed in the second quarter thanks to some strategic business diversification and promotional offers focused on the North American market.

Daedong Group's parent company and leader in future ag-tech, Daedong (Co-CEOs Kim Jun-sik and Won Yu-hyun), announced on August 14 that despite the sluggish demand in both domestic and international agricultural machinery markets throughout the first half of this year, it earned KRW 412.4 billion in consolidated sales revenue and KRW 36.1 billion in operating profit during the second quarter alone. Sales revenue did drop by roughly 5% compared to the same period last year, but operating profit increased by a remarkable 22%.

Due to high interest rates and the ongoing recession worldwide, the overseas agricultural machinery markets, including those in North America, Europe, and Australia, as well as in Korea, saw an average year-on-year decline of 10% in the first half of this year. In the domestic agricultural machinery market, the total sales of tractors and rice transplanters in the first half of the year decreased by 11% and 14%, respectively, compared to the previous year based on loans reported by Nonghyup. Moreover, due to the effects of a severe recession in the North American and European construction sectors, the performance of the construction machinery industry is rapidly decreasing, and the small construction equipment business, which is being promoted as a new business, is also struggling across the globe, which makes Daedong’s second quarter performance all the more impressive - it managed to stem the bleeding in terms of sale and boost profitability.

Daedong previously forecasted a dip in demand from “hobby farmers,” the main buyers of small and medium-sized tractors with 60 horsepower or less in what is considered the company’s “core market” in North America since last year. As such, it ramped up its sales of medium and large-sized tractors with 60 to 140 horsepower, implements, and small construction equipment in key markets such as North America, Europe, and Australia, and designed more effective strategic promotions based on thorough market research. The company says this shift in strategy was key to the performance it enjoyed during the second quarter.

On a similar note, Daedong is expecting the number of overseas exports of medium and large-sized tractors in the first half of this year to increase by approximately 17% year-on-year, and the company believes it can sell 1,000 small construction equipment, which is what it had been aiming for, overseas. In addition, the company conducted a more detailed investigation and analysis of the North American market through its “North American Business Innovation TFT,” and maximized the effectiveness of its marketing initiatives by focusing on the second quarter, the peak season in North America, with strategic promotional offers such as upgrading tractor + implement packages, interest-free installment payments options for tractors, and early purchase programs for new dealers. Meanwhile, Daedong’s European branch, which improved its business with some important organizational restructuring last year, performed roughly similarly to the same period last year despite a decrease of more than 10% in the local market, and managed to increase its sales of mid- to large-sized tractors in the new market of Türkiye.

Daedong itself is looking forward to increasing its sales and market share in North America throughout the second half of the year with a fully rebuilt organization. To that end, the company wants to make the most of its services and parts sales by offering dealers and actual users a range of remote control services and smart remote diagnosis services for agricultural machinery via the “Kioti Connect” app, which will be launched in North America and Europe in October this year. Daedong will be entering the B2B and B2G markets as well with small construction equipment such as the mid-sized GX tractor, which was launched simultaneously worldwide, the flagship large-scale model HX tractor, and skid steer loaders as well as track loaders. It also wants to build a conveyor-type assembly line that can assemble up to 8,000 tractor implements per year, thereby increasing the sales of implements.

To boost domestic sales, Daedong will actively pursue means to “actualize its future business.” This means promoting domestic sales of transport and pest control agricultural robots equipped with AI technology from Daedong AI Lab, a company specializing in AI robot S/W established earlier this year, in the fourth quarter. Daedong is doing its part in growing the smart farming solution distribution business for open fields and greenhouses, which started with garlic farms affiliated with CJ Freshway, to include not only other regular farms but also local governments and food companies across the country. Additionally, the company is promoting the commercialization of AI-driven future agricultural solutions by distributing (1) AI agricultural robots; (2) precision agriculture solutions; (3) green bio smart farms; and (4) agricultural GPT to local farms in Jeollanam-do, with which it recently signed a business agreement on facilitating the AI transformation of local agriculture.